The Top Global Risks of 2024

Over the past few decades, the global landscape has evolved at an unprecedented pace, driven by technological advancements, polarising political sentiments, rising costs of living, worsening environmental conditions, and the lingering effects of a global pandemic. While these challenges have spurred new business ideas and opportunities in certain sectors, they have also highlighted several global risks that weigh heavily on the minds of decision-makers worldwide.

Source: https://www.visualcapitalist.com/top-global-risks-in-2024/

Key Global Risks in 2024

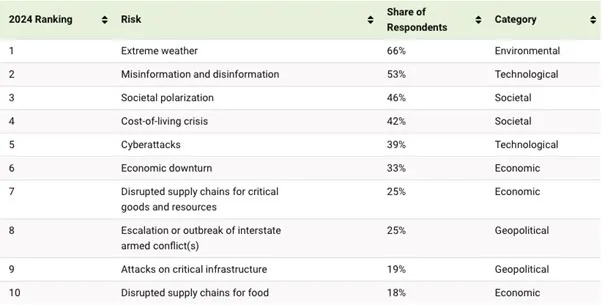

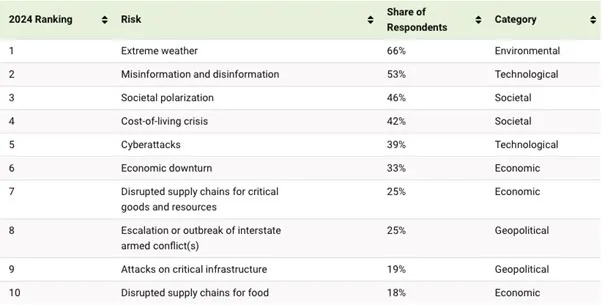

In a recent survey conducted by the World Economic Forum, 1,490 global leaders identified the top five global risks for 2024 and assessed their potential impact on the world. These risks span economic, geopolitical, societal, technological, and environmental domains.

- Extreme Weather Patterns

- 66% of leaders identified extreme weather as a major concern, a reflection of the widespread effects of global warming. In Malaysia, for example, heatwave alerts were issued in 14 different areas in April. In response, our government has introduced progressive ESG initiatives, encouraging sectors to adopt eco-friendly and sustainable practices. At PEGH, we align with these efforts as part of our commitment to lowering carbon footprints.

- AI-Generated Misinformation

- 53% of leaders cited AI-generated misinformation and disinformation as a top global risk. This issue is particularly concerning in 2024 due to the numerous elections taking place. The pervasive nature of AI-generated misinformation could exacerbate political polarisation, another top risk highlighted by 46% of leaders. In response, authorities in North America and Europe have started implementing strict regulations on AI development and usage.

- Cost-of-Living Crisis

- 42% of leaders are concerned about the ongoing cost-of-living crisis. This issue, alongside fears of cyberattacks (39%) and economic downturns (33%), continues to dominate global discussions.

Conversely, risks such as the accidental release of biological agents (9%), institutional collapse within the financial sector (7%), and housing or tech bubble bursts (4%) were less of a concern for the surveyed leaders.

What This Means for Investors

World leaders often have access to extensive research and insights across various sectors. The heightened focus on AI-generated misinformation and cyberattacks, coupled with the indifference toward a tech bubble burst, suggests that investments in cybersecurity firms may be worthwhile. Governments may support these firms in mitigating the risks, making them a promising area for investment.

In addition, growing concerns about extreme weather patterns may lead to stricter environmental regulations, further increasing the value of companies that prioritise ESG practices. This is particularly relevant for the construction and manufacturing sectors, given their significant environmental impact.

The relative indifference toward potential financial sector collapse and housing market instability indicates that traditional investments — such as stocks, bonds, and real estate — remain viable options for the foreseeable future.

A Final Thought

While this analysis offers a speculative glimpse into global risks and potential investment strategies, it’s important to remember that the complete picture is far more complex. Leaders participating in the World Economic Forum survey may not have disclosed all critical information. Therefore, as investors, it’s crucial to conduct your own research and stay informed about evolving risks and opportunities.